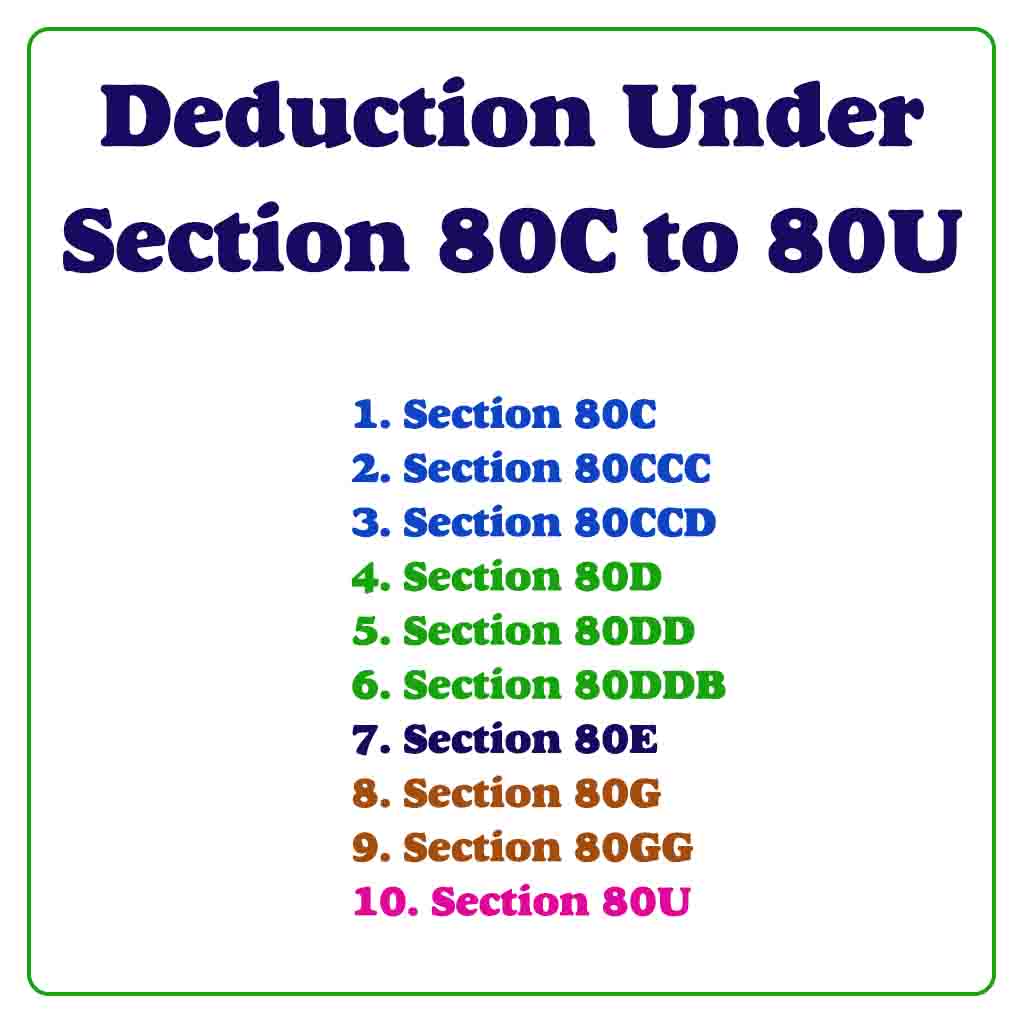

Deduction Under Section 80C to 80U : Deductions are an essential part of income tax planning. They help taxpayers to reduce their taxable income, which in turn lowers their tax liability. The Income Tax Act, 1961, provides several provisions for tax deductions. Among these, Section 80C to 80U are some of the most commonly used sections. In this blog post, we will discuss the deductions available under Section 80C to 80U.

Section 80C is the most popular section for tax deductions. It allows taxpayers to claim a deduction of up to Rs. 1.5 lakh on their taxable income. The deduction can be claimed on various investments and expenses, such as life insurance premiums, Public Provident Fund (PPF), Equity-Linked Savings Scheme (ELSS), National Savings Certificate (NSC), and others.

Section 80CCC allows taxpayers to claim a deduction on their contributions to pension plans offered by insurance companies. The deduction can be claimed up to Rs. 1.5 lakh, including the deduction claimed under Section 80C.

Section 80CCD allows taxpayers to claim a deduction on their contributions to the National Pension System (NPS). The deduction can be claimed up to Rs. 1.5 lakh, including the deduction claimed under Section 80C and Section 80CCC. An additional deduction of Rs. 50,000 is available for contributions made to the NPS Tier 1 account.

Section 80D allows taxpayers to claim a deduction on their health insurance premiums. The deduction can be claimed up to Rs. 25,000 for self, spouse, and dependent children. An additional deduction of Rs. 25,000 is available for parents. For senior citizens, the deduction limit is increased to Rs. 50,000.

Section 80DD allows taxpayers to claim a deduction on expenses incurred for the maintenance of a disabled dependent. The deduction limit is Rs. 75,000 for disability below 80% and Rs. 1.25 lakh for disability above 80%.

Section 80DDB allows taxpayers to claim a deduction on expenses incurred for the treatment of specified diseases for themselves or their dependents. The deduction limit is Rs. 40,000 for taxpayers below 60 years of age and Rs. 1 lakh for senior citizens.

Section 80E allows taxpayers to claim a deduction on the interest paid on an education loan. The deduction can be claimed for a maximum of 8 years or until the loan is repaid, whichever is earlier.

Section 80G allows taxpayers to claim a deduction on donations made to charitable organizations. The deduction limit varies depending on the type of charitable organization and ranges from 50% to 100% of the donated amount.

Section 80GG allows taxpayers who do not receive House Rent Allowance (HRA) to claim a deduction on their rent expenses. The deduction limit is the lowest of Rs. 5,000 per month, 25% of the total income, or actual rent paid minus 10% of the total income.

Section 80U allows taxpayers with disabilities to claim a deduction on their taxable income. The deduction limit is Rs. 75,000 for disability below 80% and Rs. 1.25 lakh for disability above 80%.

In conclusion, Section 80C to 80U provide several deductions that can help taxpayers to reduce their taxable income and lower their tax liability. Taxpayers should carefully evaluate their financial situation and invest in suitable investment options that meet their needs and goals. Additionally

This post was last modified on April 4, 2023 11:32 pm

Co-operative Banks vs. Credit Co-operative Societies In the world of banking and finance, institutions like co-operative banks and credit co-operative…

The Securities and Exchange Board of India (SEBI) regulates the investment advisory sector in India through the SEBI (Investment Advisers)…

Following the introduction of AePS in India, mPOS devices began to proliferate across the country. These palm-sized handheld mPOS devices…

If you're looking for a dependable and affordable mobile point-of-sale (mPOS) solution, the PAX D180 is an excellent choice. This…

Paynearby and Spice Money stand out as two prominent companies offering similar services but with subtle distinctions. Let's delve into…

As a seasoned AEPS (Aadhaar Enabled Payment System) service distributor with 6 years of experience, I can attest to the…