How Many Years Does It Take for Money to Double in an FD?

When it comes to investing, one of the most common questions people have is: “How long will it take for my money to double?” Fixed Deposits (FDs) are a popular investment option for those seeking a safe and predictable return on their money. Understanding how long it takes for money to double in an FD can help you make more informed investment decisions. One simple and effective way to estimate this is through the “Rule of 72.”

What is the Rule of 72?

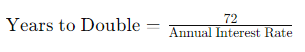

The Rule of 72 is a straightforward mathematical formula used to estimate the number of years required to double an investment at a fixed annual rate of return. The rule states:

This rule is widely used because of its simplicity and reasonable accuracy for interest rates ranging from 6% to 10%. It provides a quick way to gauge the effect of compound interest over time.

Applying the Rule of 72 to Fixed Deposits

Fixed Deposits typically offer a guaranteed return, making them a safe choice for conservative investors. Let’s explore some examples to see how the Rule of 72 applies to FDs at various interest rates.

I have build calculator for “Rule of 72” here is the link : http://banking.infintech.in/tool/rule-of-72-calculator

Example 1: FD with 6% Annual Interest Rate

If you have an FD offering a 6% annual interest rate, you can use the Rule of 72 to estimate the doubling time:

Years to Double = 72 / 6 = 12 years

So, it would take approximately 12 years for your money to double in this FD.

Example 2: FD with 8% Annual Interest Rate

For an FD with an 8% annual interest rate:

Years to Double = 72 / 8 = 9 years

Here, your investment would double in about 9 years.

Example 3: FD with 10% Annual Interest Rate

With a higher interest rate of 10%:

Years to Double = 72 / 10 = 7.2 years

In this case, your money would double in roughly 7.2 years.

Use Cases of the Rule of 72

Understanding the Rule of 72 can help you make better financial decisions. Here are some practical use cases:

Comparing Investment Options

When deciding between different investment options, the Rule of 72 can provide a quick comparison of how long it will take for each investment to double.

This can be especially useful when considering FDs versus other investment vehicles like mutual funds or stocks.

Planning for Financial Goals

If you have specific financial goals, such as funding a child’s education or planning for retirement, knowing how long it will take for your investments to double can help you strategize effectively. For example, if you need a certain amount of money in 15 years, you can use the Rule of 72 to determine the required interest rate.

Assessing the Impact of Inflation

Inflation erodes the purchasing power of money over time. By using the Rule of 72, you can understand how quickly your investments need to grow to outpace inflation.

For instance, if inflation is at 3%, your investments need to double in 24 years (72/3) just to maintain their value in real terms.

Evaluating Loan Repayments

The Rule of 72 isn’t just for investments. It can also be applied to understand the impact of interest rates on loans. For instance, if you have a loan with a 12% annual interest rate, the amount owed would double in 6 years (72/12) if no payments are made, highlighting the importance of timely repayments.

Conclusion

The Rule of 72 is a valuable tool for anyone looking to understand the impact of interest rates on their investments. While it’s a simplified method, it provides a quick and reasonably accurate estimate for doubling time, especially for fixed deposits. By applying this rule, you can make more informed financial decisions, compare investment options, plan for future goals, and even evaluate the cost of borrowing. Whether you’re a seasoned investor or just starting, the Rule of 72 can be a handy addition to your financial toolkit.