Paynearby is a leading fintech company in India that provides digital financial services to the underbanked and unbanked population of the country. It offers a range of services such as money transfer, bill payments, insurance, and more, through its network of Retailers across the country. Paynearby commissions are an important aspect of the company’s business model as it helps to incentivize its Retailers to provide these services to their customers. In this blog post, we will discuss the Paynearby commission chart for the year 2023.

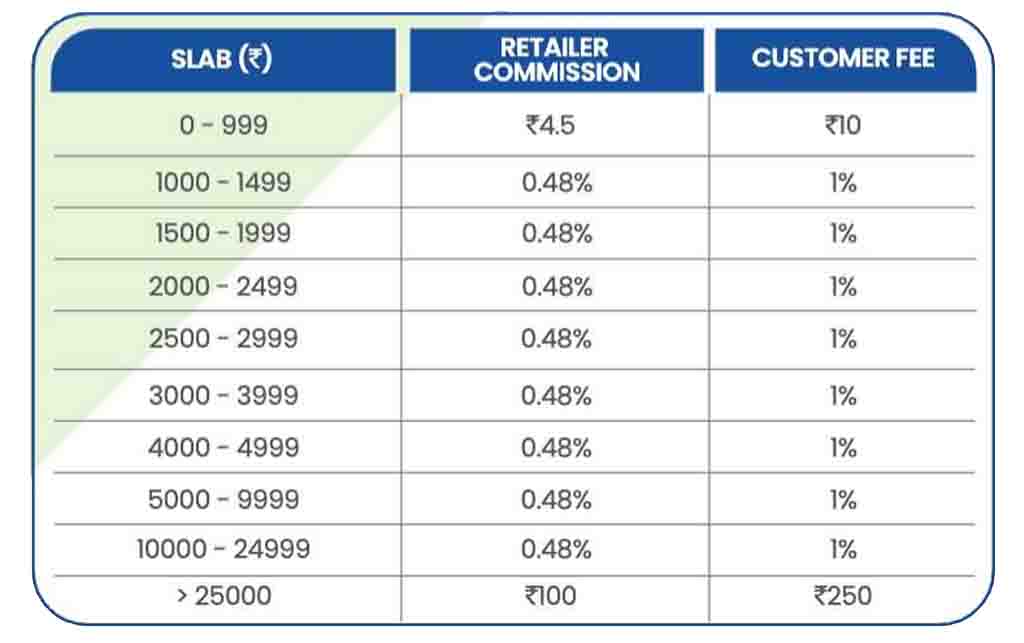

Paynearby offers its Retailers commissions on various services that they offer to their Customers. The commission rates vary depending on the service and the transaction amount. The following is the Paynearby commission chart for the year 2023:

For domestic money transfer transactions, Paynearby offers a commission of up to 0.48% of the transaction amount.

For Aadhaar-enabled payment system (AEPS) transactions, Paynearby offers a commission of up to 1% of the transaction amount. The commission rates are higher for higher transaction amounts.

For bill payments, Paynearby offers a commission of up to Rs. 5 per transaction, it depends on the type of biller and bill amount.

For insurance transactions, Paynearby offers a commission of up to 5% of the premium amount.

For prepaid recharge transactions, Paynearby offers a commission of up to 4% of the transaction amount.

For DTH recharge transactions, Paynearby offers a commission of up to 4% of the transaction amount.

For postpaid bill payment transactions, Paynearby offers a commission of up to Rs. 5 per transaction.

The above Paynearby commission chart for the year 2023 provides an overview of the commission rates offered by the company to its micro-entrepreneurs. These commissions are a crucial component of Paynearby’s business model as they help to incentivize its micro-entrepreneurs to provide digital financial services to their customers. As the adoption of digital financial services continues to grow in India, Paynearby is well-positioned to capitalize on this trend and provide financial inclusion to millions of underbanked and unbanked Indians.

This post was last modified on May 5, 2023 7:59 am

Co-operative Banks vs. Credit Co-operative Societies In the world of banking and finance, institutions like co-operative banks and credit co-operative…

The Securities and Exchange Board of India (SEBI) regulates the investment advisory sector in India through the SEBI (Investment Advisers)…

Following the introduction of AePS in India, mPOS devices began to proliferate across the country. These palm-sized handheld mPOS devices…

If you're looking for a dependable and affordable mobile point-of-sale (mPOS) solution, the PAX D180 is an excellent choice. This…

Paynearby and Spice Money stand out as two prominent companies offering similar services but with subtle distinctions. Let's delve into…

As a seasoned AEPS (Aadhaar Enabled Payment System) service distributor with 6 years of experience, I can attest to the…