Paynearby Commission Chart 2023

Paynearby is a leading fintech company in India that provides digital financial services to the underbanked and unbanked population of the country. It offers a range of services such as money transfer, bill payments, insurance, and more, through its network of Retailers across the country. Paynearby commissions are an important aspect of the company’s business model as it helps to incentivize its Retailers to provide these services to their customers. In this blog post, we will discuss the Paynearby commission chart for the year 2023.

Additional Reading

Paynearby Commission Chart 2023

Paynearby offers its Retailers commissions on various services that they offer to their Customers. The commission rates vary depending on the service and the transaction amount. The following is the Paynearby commission chart for the year 2023:

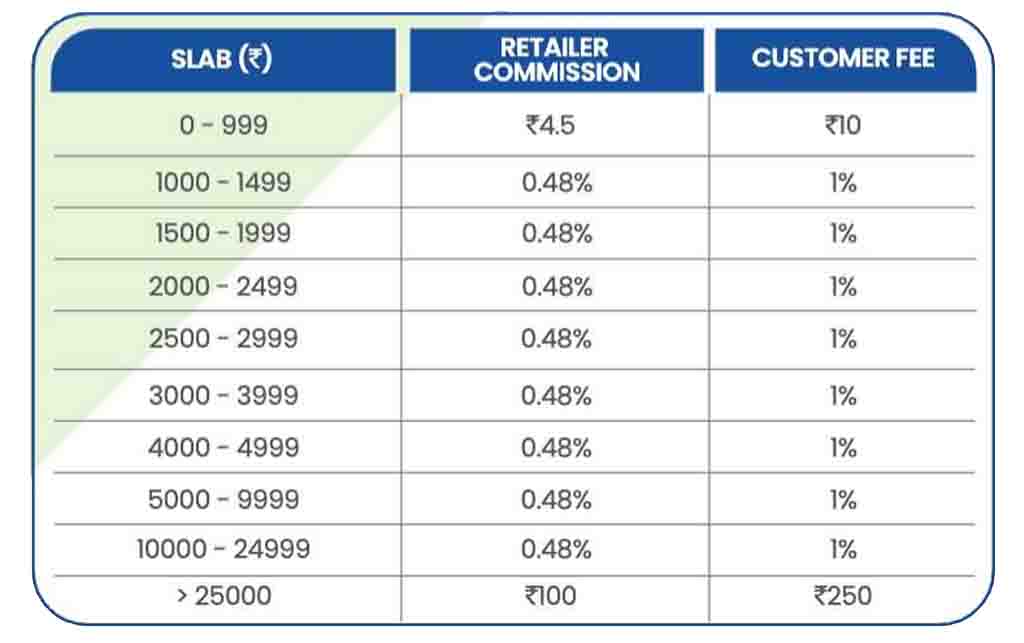

1) Commission on Money Transfer

For domestic money transfer transactions, Paynearby offers a commission of up to 0.48% of the transaction amount.

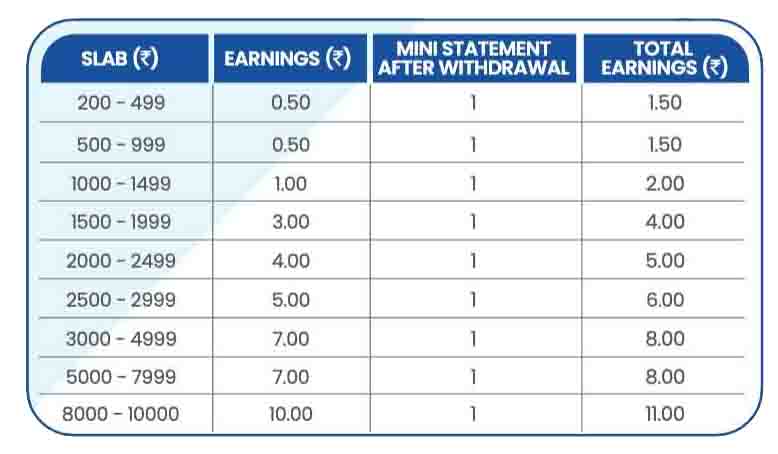

2) AEPS

For Aadhaar-enabled payment system (AEPS) transactions, Paynearby offers a commission of up to 1% of the transaction amount. The commission rates are higher for higher transaction amounts.

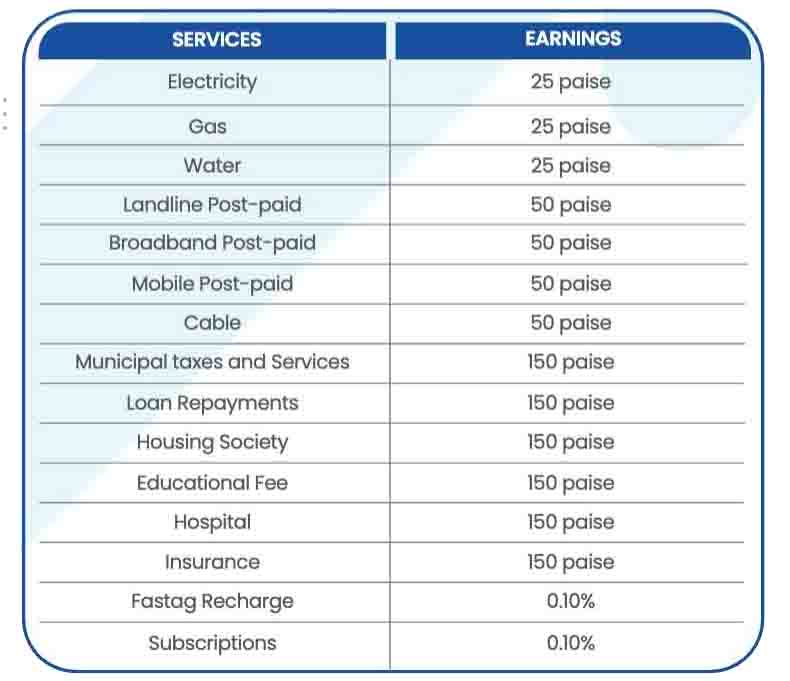

3) Bill Payments

For bill payments, Paynearby offers a commission of up to Rs. 5 per transaction, it depends on the type of biller and bill amount.

4) Insurance

For insurance transactions, Paynearby offers a commission of up to 5% of the premium amount.

5) Prepaid Recharge

For prepaid recharge transactions, Paynearby offers a commission of up to 4% of the transaction amount.

6) DTH Recharge

For DTH recharge transactions, Paynearby offers a commission of up to 4% of the transaction amount.

7) Postpaid Bill Payments

For postpaid bill payment transactions, Paynearby offers a commission of up to Rs. 5 per transaction.

Conclusion

The above Paynearby commission chart for the year 2023 provides an overview of the commission rates offered by the company to its micro-entrepreneurs. These commissions are a crucial component of Paynearby’s business model as they help to incentivize its micro-entrepreneurs to provide digital financial services to their customers. As the adoption of digital financial services continues to grow in India, Paynearby is well-positioned to capitalize on this trend and provide financial inclusion to millions of underbanked and unbanked Indians.