Understanding Buy Now Pay Later: A Comprehensive Guide

Have you ever found yourself eyeing a product you really want, but hesitant to purchase it due to the high price tag? Or have you ever needed to make an urgent purchase but didn’t have enough funds at the moment? That’s where Buy Now Pay Later (BNPL) comes in. BNPL is a payment option that has become increasingly popular among consumers, especially online shoppers. In this article, we’ll take a closer look at what BNPL is, how it works, and the pros and cons of using this payment method.

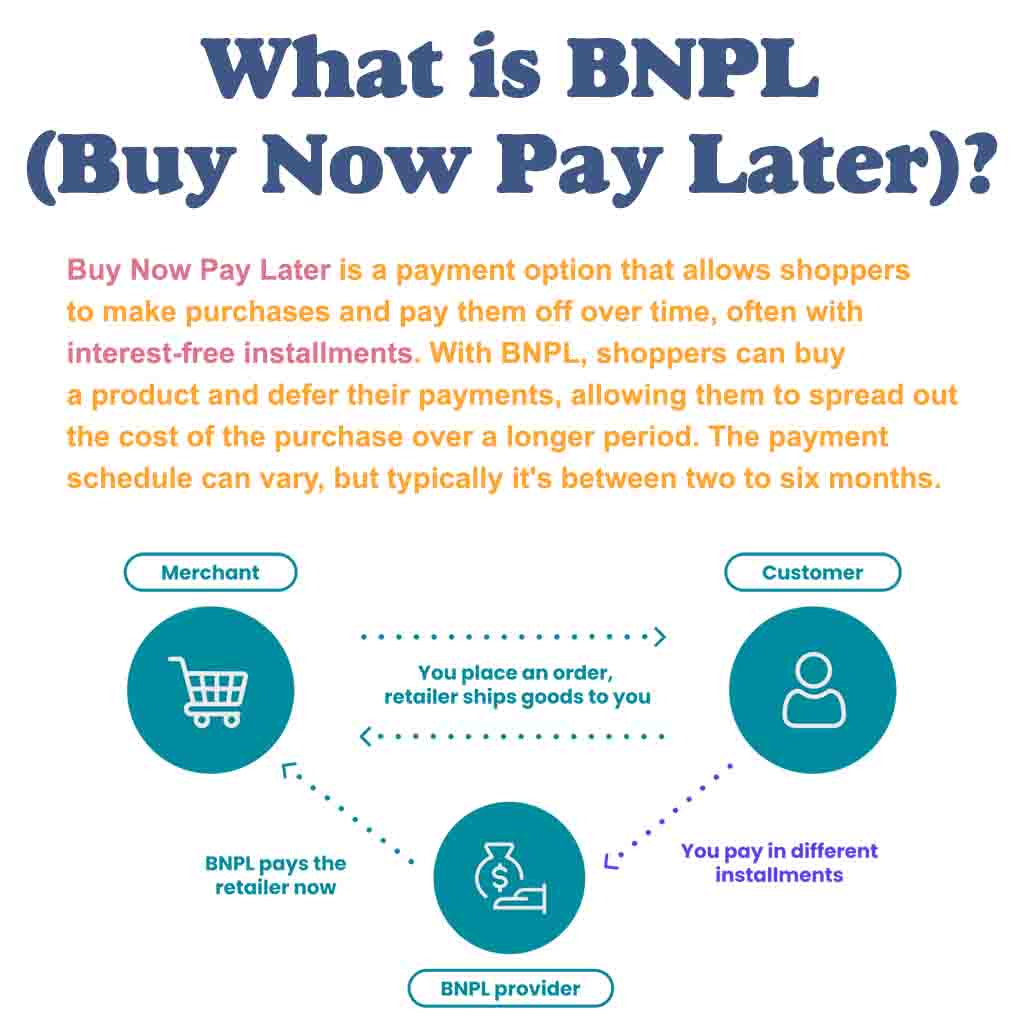

What is Buy Now Pay Later?

Buy Now Pay Later is a payment option that allows shoppers to make purchases and pay them off over time, often with interest-free installments. With BNPL, shoppers can buy a product and defer their payments, allowing them to spread out the cost of the purchase over a longer period. The payment schedule can vary, but typically it’s between two to six months.

How does Buy Now Pay Later work?

BNPL is often offered as a payment option at checkout on online retail sites or apps. After selecting BNPL, shoppers are required to provide some personal and financial information to the BNPL provider. Once the application is approved, the BNPL provider pays the retailer or merchant for the purchase, and the shopper repays the BNPL provider over time. The payment schedule and terms can vary depending on the provider, but usually, the shopper is required to make regular installments, often monthly, until the purchase is paid off.

Advantages of Buy Now Pay Later

No Interest

Many BNPL providers offer interest-free installments, which can be an attractive option for shoppers who want to spread out the cost of a purchase without incurring additional fees.

Easy Application

Applying for BNPL is often quick and easy. Many retailers and online stores offer this payment option at checkout, and the application process can be completed within minutes.

No Upfront Payment

With BNPL, shoppers don’t have to make an upfront payment for their purchase. This can be especially helpful for people who need to make an urgent purchase but don’t have enough funds at the moment.

Disadvantages of Buy Now Pay Later

Late Fees

If shoppers miss a payment or fail to pay on time, they may incur late fees or penalties, which can add up over time.

Debt Accumulation

BNPL can be a slippery slope for some shoppers. If they take advantage of this payment option too often, they may accumulate debt that they cannot afford to pay off, leading to financial difficulties.

Impact on Credit Score

Late or missed payments on BNPL purchases can negatively impact shoppers’ credit scores, making it harder for them to obtain credit in the future.

Related Articles

Conclusion

Buy Now Pay Later can be a convenient and flexible payment option for shoppers who want to spread out the cost of a purchase over a longer period. However, shoppers should carefully consider the terms and conditions of the BNPL provider before using this payment option. If used responsibly, BNPL can be a helpful tool for managing finances. However, if shoppers don’t fully understand the costs and risks associated with BNPL, it may end up costing them more than they bargained for.