Credit cards have become a ubiquitous financial tool in today’s world, and they have revolutionized the way we transact and pay for our purchases. A credit card is a payment card issued by a financial institution that allows the cardholder to borrow funds to pay for goods and services. In essence, a credit card is a line of credit that is extended to the cardholder.

When you use a credit card to make a purchase, you are essentially borrowing money from the card issuer, and you are obligated to pay back the amount borrowed along with any interest and fees that may apply. However, credit cards offer a range of benefits such as convenience, security, and rewards, which make them an attractive payment option for many people.

Using a credit card is easy, and it can be broken down into a few simple steps:

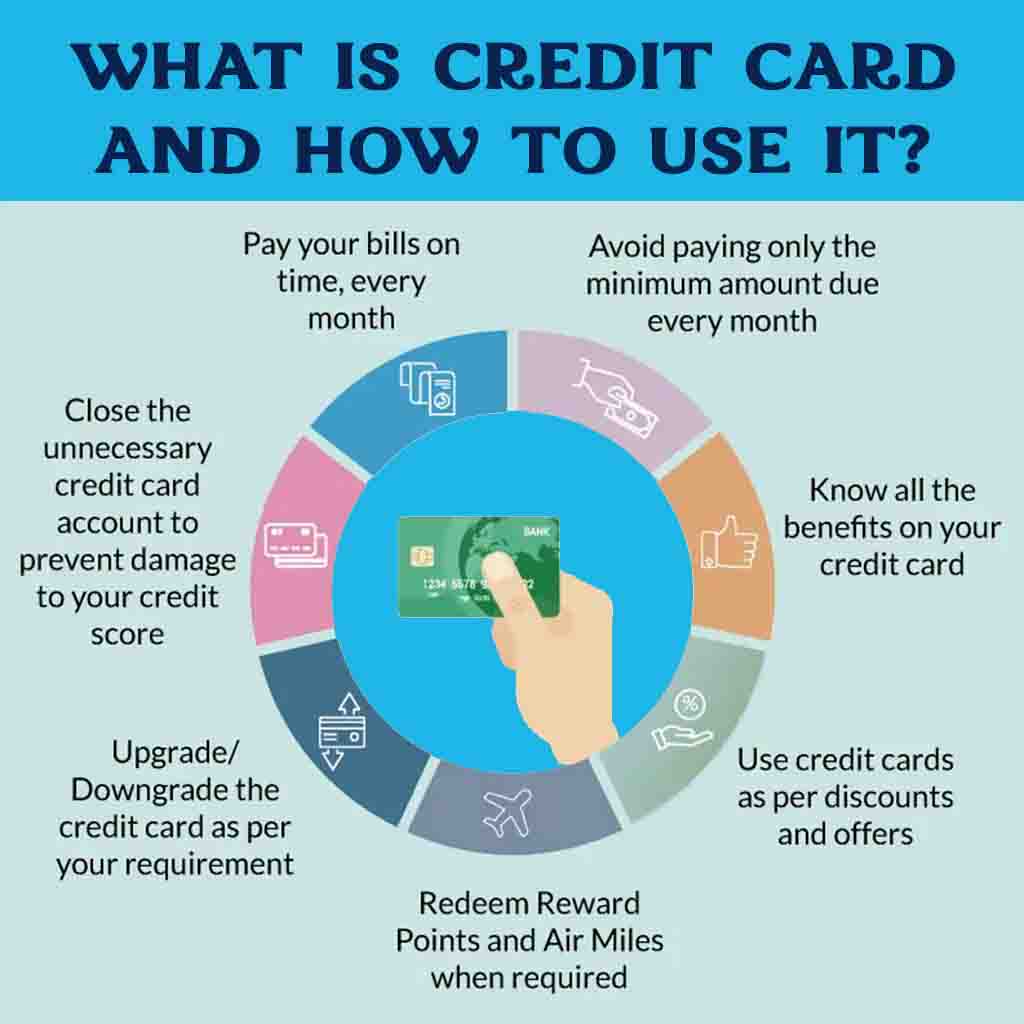

Using a credit card responsibly is crucial to avoid falling into debt and damaging your credit score. Here are some tips to help you use your credit card effectively:

Credit cards are a convenient and useful financial tool, but they should be used responsibly to avoid accumulating debt and damaging your credit score. By following the tips outlined above, you can effectively use your credit card to make purchases, earn rewards, and build a positive credit history.

This post was last modified on April 16, 2023 8:13 am

Co-operative Banks vs. Credit Co-operative Societies In the world of banking and finance, institutions like co-operative banks and credit co-operative…

The Securities and Exchange Board of India (SEBI) regulates the investment advisory sector in India through the SEBI (Investment Advisers)…

Following the introduction of AePS in India, mPOS devices began to proliferate across the country. These palm-sized handheld mPOS devices…

If you're looking for a dependable and affordable mobile point-of-sale (mPOS) solution, the PAX D180 is an excellent choice. This…

Paynearby and Spice Money stand out as two prominent companies offering similar services but with subtle distinctions. Let's delve into…

As a seasoned AEPS (Aadhaar Enabled Payment System) service distributor with 6 years of experience, I can attest to the…