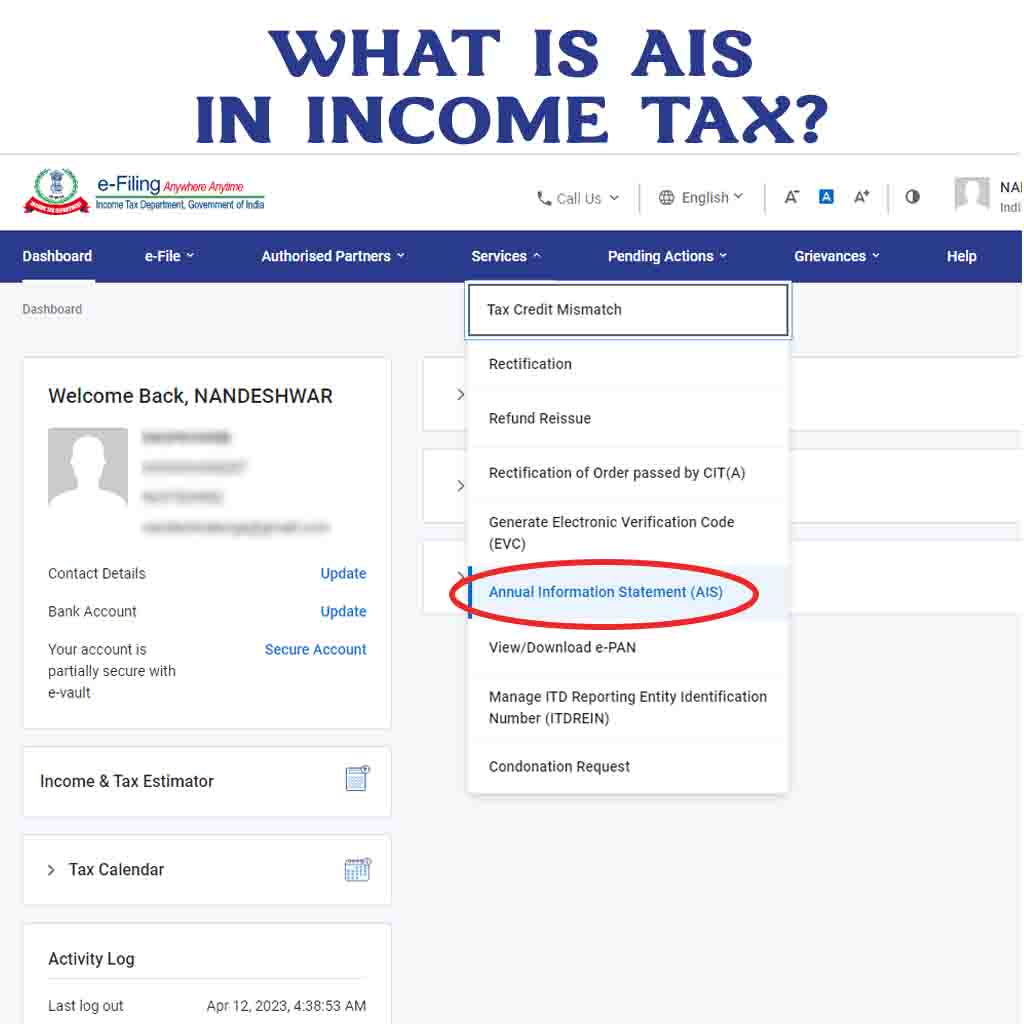

AIS in Income Tax

The Annual Information Statement (AIS) is an important document issued by the Indian income tax department to taxpayers. The statement contains information related to the income earned by the taxpayer and taxes paid during a given financial year. It is a vital document that can help taxpayers ensure they have accurately reported their income and taxes on their income tax returns.

What is an Annual Information Statement?

The Annual Information Statement (AIS) is a document that summarizes the financial transactions of a taxpayer during a particular financial year. The statement contains information on various types of financial transactions such as salary, interest, dividends, and capital gains.

AIS is usually issued by banks, mutual funds, insurance companies, and other financial institutions that have received payments from the taxpayer during the financial year. The statement is typically issued by the end of May of the following financial year and can be accessed online through the taxpayer’s income tax account.

What information is included in the AIS?

The Annual Information Statement (AIS) contains several types of financial information related to the taxpayer, such as:

- Income from salary: The statement contains information related to the salary earned by the taxpayer during the financial year, including details on tax deducted at source (TDS).

- Income from other sources: The statement contains information on interest income, dividend income, and other types of income earned by the taxpayer.

- Capital gains: The statement contains information on capital gains earned by the taxpayer, including short-term and long-term capital gains.

- Taxes paid: The statement contains information on taxes paid by the taxpayer, including advance tax, self-assessment tax, and TDS.

- Deductions claimed: The statement contains information on deductions claimed by the taxpayer, such as deductions for insurance premiums, donations, and investments.

Why is AIS important?

The Annual Information Statement (AIS) is an essential document that helps taxpayers ensure they have accurately reported their income and taxes on their income tax returns. The statement can help taxpayers identify any discrepancies or errors in their income tax returns and take corrective action.

AIS can also help taxpayers avoid penalties and interest charges for underreporting their income or taxes. By reviewing the information in the AIS, taxpayers can ensure that they have claimed all eligible deductions and have paid the correct amount of tax.

Related Articles

Conclusion

The Annual Information Statement (AIS) is an essential document that summarizes the financial transactions of a taxpayer during a given financial year. The statement contains information related to the taxpayer’s income, taxes paid, and deductions claimed. By reviewing the AIS, taxpayers can ensure that they have accurately reported their income and taxes on their income tax returns and avoid any penalties or interest charges for underreporting their income or taxes.