What is ITR-1?

Income Tax Return-1, commonly known as ITR-1, is a form that individuals use to file their income tax returns. ITR-1 is the simplest form available for filing income tax returns and is meant for taxpayers who have income from salaries, pensions, or interest from savings accounts. In this blog post, we will discuss the basics of ITR-1, who should file it, the procedure to file ITR-1, and the due date for filing ITR-1.

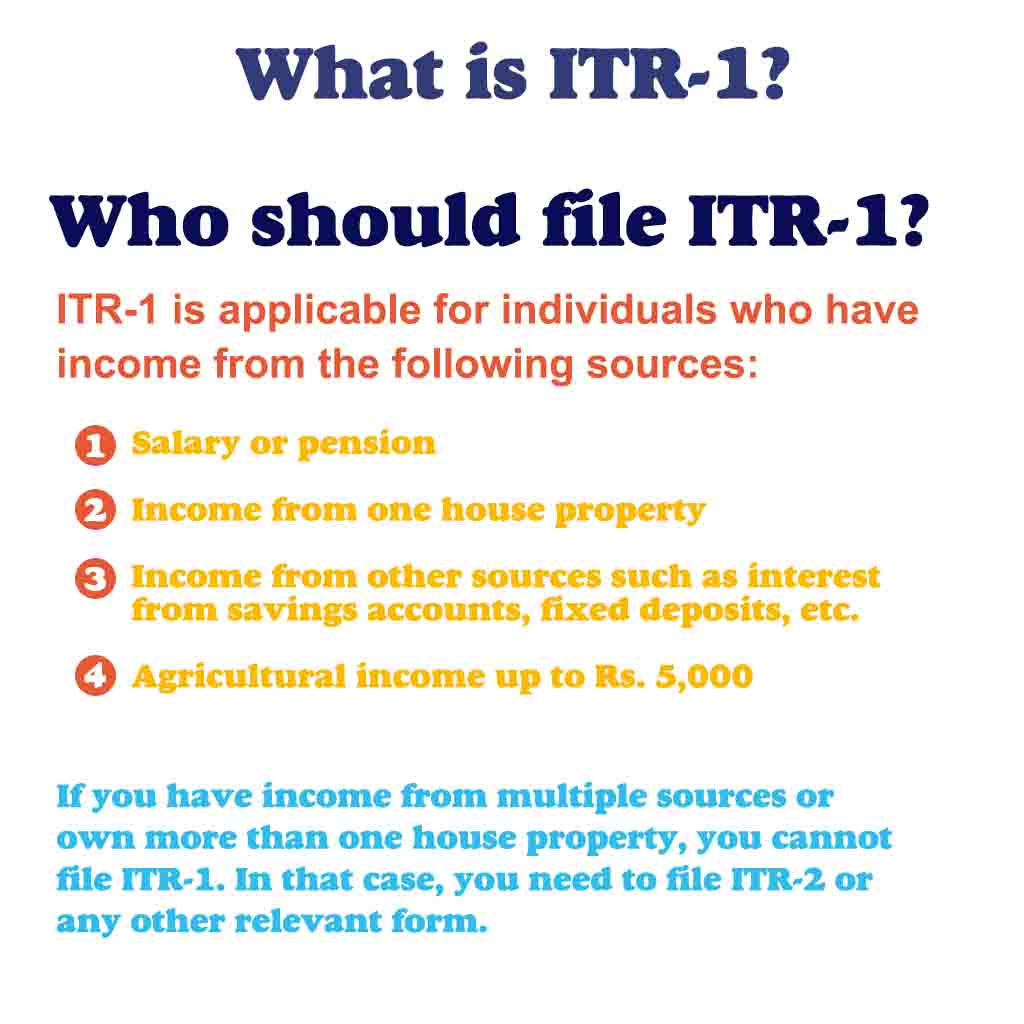

Who should file ITR-1?

ITR-1 is applicable for individuals who have income from the following sources:

- Salary or pension

- Income from one house property

- Income from other sources such as interest from savings accounts, fixed deposits, etc.

- Agricultural income up to Rs. 5,000

If you have income from multiple sources or own more than one house property, you cannot file ITR-1. In that case, you need to file ITR-2 or any other relevant form.

Procedure to file ITR-1

The process of filing ITR-1 is straightforward. You can either file it online or offline. Here are the steps to file ITR-1:

- Gather all the necessary documents: Before you start filing ITR-1, ensure that you have all the necessary documents like Form 16, salary slips, bank statements, TDS certificates, etc.

- Login to the e-filing portal: If you are filing ITR-1 online, you need to visit the Income Tax Department’s e-filing portal and log in using your credentials.

- Fill in the details: Once you have logged in, select ITR-1 and start filling in the details such as personal information, income from different sources, deductions, etc.

- Verify the details: After filling in all the details, verify them and ensure that there are no errors.

- Submit the form: Once you have verified the details, submit the form electronically. You will receive an acknowledgement once the form is successfully submitted.

Due date for filing ITR-1

The due date for filing ITR-1 is usually July 31st of the assessment year (AY). For example, for the financial year 2022-23, the due date for filing ITR-1 would be July 31st, 2023. However, the government may extend the deadline in certain cases, and it is always advisable to file the returns well before the due date to avoid any penalties or late fees.

Related Articles

Conclusion

In conclusion, ITR-1 is the simplest form available for filing income tax returns and is suitable for individuals who have income from salaries, pensions, or interest from savings accounts. By following the simple steps mentioned above, you can easily file ITR-1 online and ensure that you are compliant with the income tax laws.

FAQs – Frequently Asked Questions

Q: What is ITR-1?

A: ITR-1 is a tax return form that is used by individual taxpayers in India to file their income tax returns.

Q: Who is eligible to file ITR-1?

A: Individual taxpayers who have a total income of up to Rs. 50 lakh and have earned income from salary, one house property, and other sources such as interest, etc., can file ITR-1.

Q: Can an individual file ITR-1 if they have income from capital gains?

A: No, individuals who have income from capital gains cannot file ITR-1. They need to file ITR-2 instead.

Q: Is it mandatory to file ITR-1?

A: No, it is not mandatory for all individuals to file ITR-1. However, if an individual’s total income exceeds the basic exemption limit, then they are required to file an income tax return.

Q: What is the due date for filing ITR-1?

A: The due date for filing ITR-1 is generally July 31 of the relevant assessment year. However, for the assessment year 2021-22, the due date has been extended to September 30, 2022.

Q: Can I file ITR-1 online?

A: Yes, individuals can file ITR-1 online by visiting the Income Tax Department’s e-filing website.

Q: What documents do I need to file ITR-1?

A: You will need your PAN card, Aadhaar card, Form 16 (if applicable), bank statements, TDS certificates, and other relevant documents related to your income and investments.

Q: Can I revise my ITR-1 after filing it?

A: Yes, you can revise your ITR-1 within the prescribed time limit if you have made any mistakes or omissions in the original return.

Q: What happens if I fail to file my ITR-1?

A: If you fail to file your ITR-1 by the due date, you may be liable to pay a penalty and interest on the amount of tax due. Additionally, you may also be barred from carrying forward certain losses or claiming certain deductions.