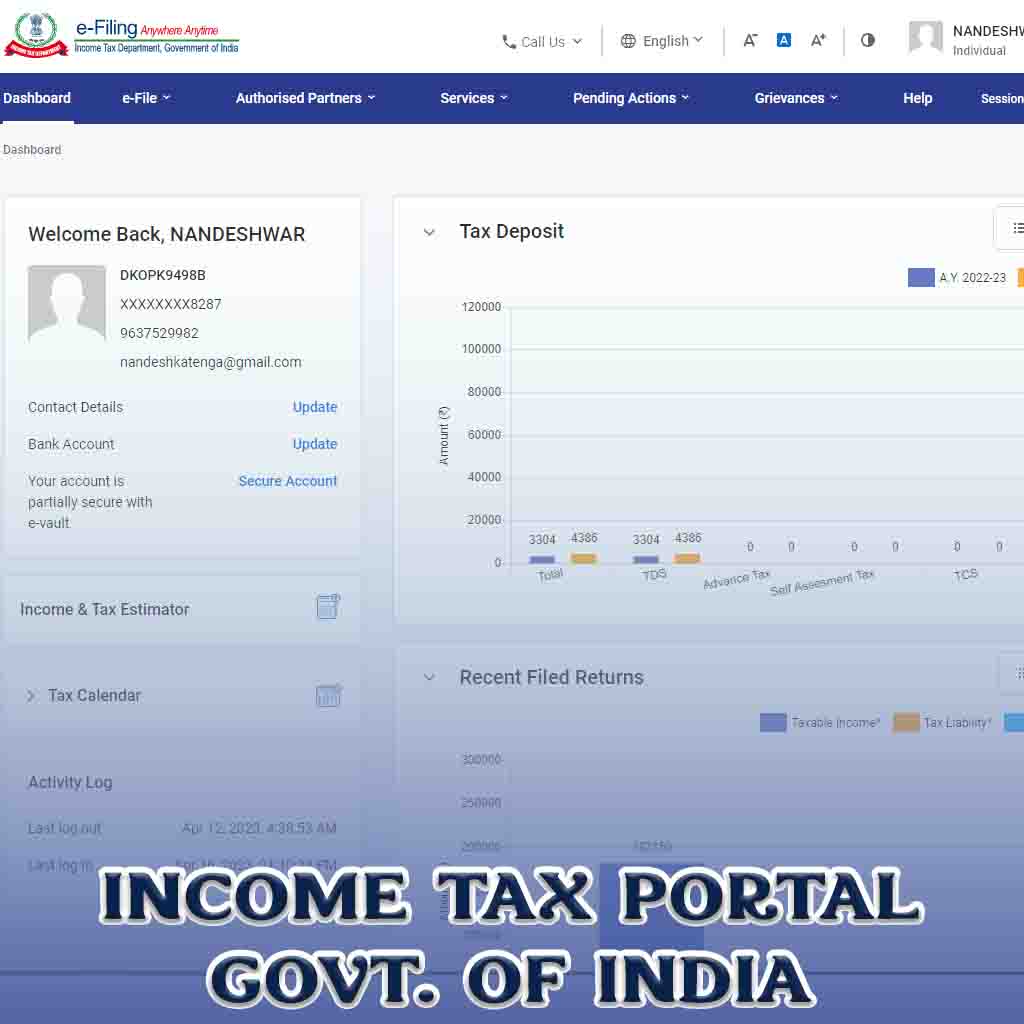

Income tax portal

As taxpayers, we are required to pay income tax on our earnings. In the past, the process of filing income tax returns was often a tedious and time-consuming process. However, with the advent of technology, the Indian government has introduced the income tax portal, which has made the entire process a lot easier and more convenient.

In this article, we will explore what the income tax portal is and how it benefits taxpayers in India.

Official Website : https://www.incometax.gov.in

What is the income tax portal?

The income tax portal is a website that is designed and developed by the Income Tax Department of India. It is an online platform that allows taxpayers to file their income tax returns electronically. The portal has been developed with the aim of simplifying the process of tax payment and making it more convenient for taxpayers.

The income tax portal offers a range of services to taxpayers, including the ability to file income tax returns, pay taxes online, track tax refunds, and view tax credit statements. The portal also provides taxpayers with access to a range of useful resources and tools, such as tax calculators, e-filing tutorials, and frequently asked questions.

What are the benefits of using the income tax portal?

There are several benefits to using the income tax portal to file your income tax returns. Some of these benefits include:

- Convenience: The income tax portal allows taxpayers to file their income tax returns from the comfort of their own homes or offices. This saves a lot of time and effort that would otherwise be spent visiting the tax office.

- Speed: The online filing process is much faster than the traditional paper-based system. Taxpayers can file their returns online in just a few minutes, rather than having to fill out long forms by hand.

- Accuracy: The online filing process is more accurate than the paper-based system, as the portal checks for errors and omissions before allowing taxpayers to submit their returns. This helps to reduce the number of mistakes that are made when filing returns.

- Transparency: The income tax portal provides taxpayers with access to all of their tax information in one place. This makes it easier to keep track of tax payments and refunds, as well as to view tax credit statements.

- Security: The income tax portal is a secure platform that uses encryption to protect taxpayers’ personal and financial information. This helps to prevent identity theft and other forms of fraud.

How to use the income tax portal?

To use the income tax portal, you will need to follow these steps:

- Register on the portal: To use the income tax portal, you will need to register for an account. You can do this by visiting the portal and clicking on the “Register Yourself” button.

- Log in to your account: Once you have registered, you can log in to your account using your user ID and password.

- File your income tax returns: To file your income tax returns, click on the “e-File” button and follow the instructions on the screen.

- Pay your taxes: To pay your taxes online, click on the “Pay Taxes Online” button and follow the instructions on the screen.

- Track your tax refunds: To track your tax refunds, click on the “Refund/Demand Status” button and enter the relevant details.

Related Articles

Conclusion

The income tax portal is a valuable tool for taxpayers in India. It has simplified the process of tax payment and made it more convenient and accessible for everyone. By using the portal, taxpayers can save time, reduce errors, and ensure that their tax payments are accurate and up-to-date. If you haven’t already started using the income tax portal, it’s time to take advantage of this useful resource and make your tax payments easier and more convenient.